Smartphone insurance plans are your gateway to peace of mind in the digital age. They are designed to protect your valuable device from the unexpected – from accidental drops and spills to theft and loss. Imagine a world where a cracked screen doesn’t mean a financial setback, or a stolen phone doesn’t disrupt your life. This is the promise of a comprehensive smartphone protection plan, offering a safety net for your most essential tech companion.

These plans go beyond basic warranties, covering a range of risks and providing valuable benefits. Whether you’re a frequent traveler, a busy professional, or simply someone who relies on their phone daily, understanding the different types of plans, coverage options, and claim processes is crucial. From manufacturer warranties to third-party insurance and carrier-provided options, we’ll explore the landscape, helping you make an informed decision to safeguard your investment and your connectivity.

Introduction to Smartphone Protection: Smartphone Insurance Plans

In today’s fast-paced world, smartphones are indispensable tools. They hold our contacts, photos, important documents, and connect us to the world. Given their critical role, protecting these devices is paramount. Smartphone protection plans offer a safety net, ensuring that you can continue using your device without significant financial setbacks in case of unforeseen events. These plans are designed to safeguard your investment and provide peace of mind.

Provide a concise definition of smartphone protection plans, highlighting their primary function.

Smartphone protection plans are insurance policies designed to cover the costs associated with damage, loss, or theft of a smartphone. Their primary function is to mitigate the financial burden of replacing or repairing a damaged device. These plans offer a financial cushion against unexpected incidents, allowing users to maintain access to their essential communication and information hub.

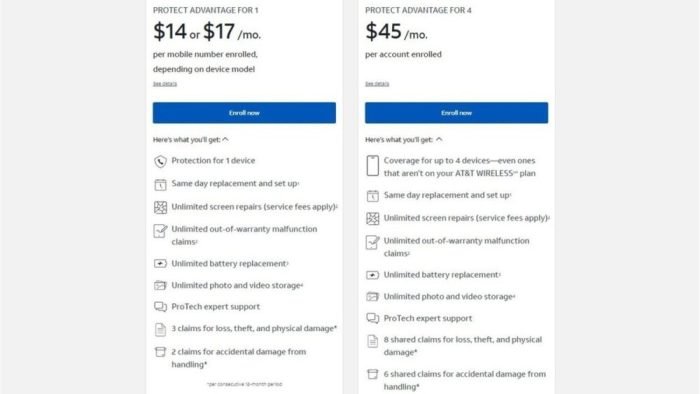

Detail the common risks these plans cover, such as accidental damage, theft, and loss., Smartphone insurance plans

Source: androidauthority.com

Protection plans typically cover a range of risks. These include:

- Accidental Damage: This covers damage resulting from drops, spills, or other unintentional events that can damage the screen, internal components, or the device’s exterior.

- Theft: If your phone is stolen, the plan may cover the cost of a replacement device, subject to certain conditions and deductibles.

- Loss: Some plans extend coverage to include the loss of your phone, providing a replacement or financial reimbursement.

Share the benefits of having a protection plan versus not having one, focusing on peace of mind.

The benefits of having a protection plan are substantial, especially compared to the alternative. Without a plan, you are solely responsible for the costs associated with damage, loss, or theft. These costs can be significant, potentially running into hundreds or even thousands of dollars, depending on the device and the extent of the damage. With a protection plan, you gain:

- Financial Security: Knowing that your device is covered reduces the financial risk of unexpected events.

- Peace of Mind: You can use your phone without constant worry about potential damage or loss.

- Convenience: Protection plans often include expedited repair or replacement services, minimizing downtime.

Last Word

In conclusion, smartphone insurance plans offer a vital layer of protection in today’s mobile-centric world. By understanding the various plan types, assessing your personal needs, and considering the cost-value proposition, you can choose a plan that aligns with your lifestyle and provides the security you deserve. Remember, proactive protection, coupled with preventive measures, ensures your smartphone remains a reliable companion, ready for whatever life throws your way.